The Production is guaranteed by the military empire relying on slave labor. 70% of US chocolate is from child slave labor - 1 million kids in Africa - for example. The Petrodollar is propped up by the military. China created the FIRST paper dollar ever - it's value was enforced by the military. Nothing has changed. Get ready for increased military crackdowns in the U.S. and also mass microchipping.

What lifted US stocks to 1929 levels in 1929?

Margin lending and share buybacks.

What lifted US stocks to 1929 levels in 2019?

Margin lending and share buybacks.

We owe the banks more than $250 trillion in terms of global debts like mortgages, business loans, credit card debt and government debt. video

On the same note, our banks are already super leveraged because the worldwide bank capital is only $10 trillion. At the same time, we have a $250 trillion global debt. This means that we have a 1:25 leverage.

Citi, JPMorgan Chase, Bank of America and five other major banks said over the weekend that they'd stop buying back their own shares through June as they pledge to help struggling consumers and businesses. https://www.politico.com/news/2020/03/16/big-banks-coronavirus-onslaught-132997

Strategists say yields, which move opposite price, are going higher because a big government stimulus package could create $1 trillion or more in new debt on top of the already $1 trillion U.S. deficit.

https://www.youtube.com/watch?v=pndmzbMZZ4s Valuations are now 30% down from previous Bubble due to Stock Buyback FED scam. $3 or $4 trillion Stimulus needed.... Socialism for the rich and Stock Buybacks once again promoted...

The shares it buys back become worthless. There are different ways of accounting for it on the balance sheet. Most companies cancel the shares they buy back. They just disappear.

BBC Business Daily news report - are Stock Buybacks a Corporate Scam?

"Stock buybacks have been a prime mode of both concentrating income among the richest households and eroding middle-class employment opportunities," said William Lazonick, a professor at the University of Massachusetts Lowell who has studied the impact of stock buybacks.https://www.reuters.com/article/us-goldman-sachs-buyback-breakingviews/breakingviews-hadas-share-buybacks-arent-worth-defending-idUSKCN1QU25T

Between 1971 and 1982, shareholders received closer to half of reported profit. That rose to 70 percent between 1983 and 2001 and to 90 percent since 2002.

Airlines are begging for a bailout, but they've used 96% of their cash on buybacks over the past 10 years.

And the record amount of corporate debt – “record” by any measure – that has piled up since 2012 has become the Fed’s number one concern as trigger of the next financial crisis. So here we are.

In 2018, even the SEC got briefly nervous about the ravenous share buybacks and what they did to corporate financial and operational health. “On too many occasions, companies doing buybacks have failed to make the long-term investments in innovation or their workforce that our economy so badly needs,” SEC Commissioner Jackson pointed out.My original source was from a few years ago. So I'll try find it. Here is a more recent source. https://seekingalpha.com/article/4293859-peak-buybacks-corporate-indulgence-hit-limits

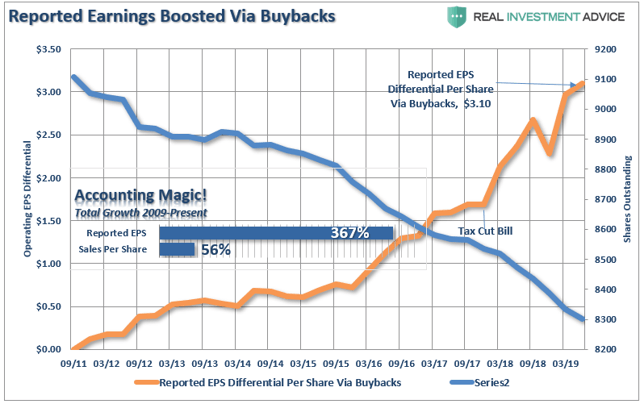

So it says since 2009 the

"As the chart below shows, while earnings per share have risen by over 360% since the beginning of 2009; revenue growth has barely eclipsed 50%."

And the chart shows "stocks boosted by buybacks." So if you do the math - 50% is about 14% of 360% - meaning that about 86% of the wall st stock growth has been from previously illegal stock buybacks - all based on cheap FED money. Think of it this way - 10% would be 36% so 50 is about 14% of 360% growth.

Nomi Prins goes into details as does Michael E. Hudson, economics Ph.D. So now let's look at some other sources.

"Without that $4 trillion in stock buybacks, not to mention the $4 trillion in liquidity from the Federal Reserve, the stock market would not have been able to rise as much as it has."

So now this source: https://money.com/stock-buyback-boom-over/

"selling bonds to a market hungry for an alternative to Treasury bonds and their extremely low yields. That same hunger, which has as its underlying cause extraordinary monetary policy, has also driven appetite for equities, as investors felt forced to take on more risk to gain even a modicum of reward.Rising debt but falling enthusiasm

Companies have issued debt in such size that net debt compared to a standard measure of earnings is now at an all-time high for non-financial companies in the S&P 500, according to data from FactSet, having almost doubled in about five years.

Yet investors seem less enthusiastic about company buyback plans. A Goldman Sachs basket of companies with the highest share repurchases has underperformed the broader market this year."

And a third source: https://www.theatlantic.com/politics/archive/2015/02/kill-stock-buyback-to-save-the-american-economy/385259/

"Much of it went to stock buybacks—more than $6.9 trillion of them since 2004, according to data compiled by Mustafa Erdem Sakinç of The Academic-Industry Research Network. Over the past decade, the companies that make up the S&P 500 have spent an astounding 54 percent of profits on stock buybacks. Last year alone, U.S. corporations spent about $700 billion, or roughly 4 percent of GDP, to prop up their share prices by repurchasing their own stock."

And stock buybacks are part of the NeoNazi revolution of Ray-Gun:

Also the youtube channel Money GPS exposes the Stock Buyback scam (vid)."Before 1982, when John Shad, a former Wall Street CEO in charge of the Securities and Exchange Commission loosened regulations that define stock manipulation, corporate managers avoided stock buybacks out of fear of prosecution. "

https://wolfstreet.com/2019/04/08/what-would-stocks-do-in-a-world-without-buybacks-goldman-asks/

"The net effect of these investor groups is that they together shed $1.1 trillion of shares (included in these categories, and spread over them, are ETFs). But the $1.1 trillion of shares that these investor groups shed over those five years was overpowered by $2.95 trillion of share buybacks over those five years."https://www.theatlantic.com/magazine/archive/2019/08/the-stock-buyback-swindle/592774/

By contrast, according to Federal Reserve data compiled by Goldman Sachs, over the past nine years, corporations have put more money into their own stocks—an astonishing $3.8 trillion—than every other type of investor (individuals, mutual funds, pension funds, foreign investors) combined. Money GPS on why Stock Buybacks are the ONLY reason that Wall St. has grown - vidhttps://www.counterpunch.org/2019/02/28/survival-of-the-richest-all-are-equal-except-those-who-arent/

In contrast, 64% of the population (with an average of $10,000 in wealth to their name) holds less than 2%.https://www.counterpunch.org/2019/02/01/wall-street-banks-and-angry-citizens/

the U.S. central bank, the Federal Reserve. It helped spark that increase in wealth disparity domestically and globally by adopting a post-crisis monetary policy in which electronically fabricated money (via a program called quantitative easing, or QE) was offered to banks and corporations at significantly cheaper rates than to ordinary Americans.https://realinvestmentadvice.com/the-disconnect-between-the-markets-economy-has-grown/

The reality is that after 3-massive Federal Reserve driven “Quantitative Easing” programs, a maturity extension program, bailouts of TARP, TGLP, TGLF, etc., HAMP, HARP, direct bailouts of Bear Stearns, AIG, GM, bank supports, etc., all of which total more than $33 Trillion, the economy grew by just $3.87 Trillion, or a whopping 24.11% since the beginning of 2009. The ROI equates to $8.53 of interventions for every $1 of economic growth.Stock Buyback insider training vid - Money GPS

2019 Huge Stock Buyback boom - Money gps vid

will stock buybacks be illegal? - vid

another Stock Buyback expose vid from Money GPS

2015 stock buyback vid from money gps

The sell-off among US Treasuries with 10-year maturities is seriously rattling nerves. The 10-year yield spiked to 1.22% early this morning (when the price of a bond falls, its yield rises by definition).

So why the sell-off in long-dated Treasuries and gold, even as stocks are plunging and as the housing market in many areas in the US – particularly where it had been the most inflated – has essentially shut down due to lockdowns and other restrictions?

Here is my theory. The reasons fall largely into two categories:

One, in terms of Treasuries, there is the expected tsunami of supply as the government will implement stimulus and bailout packages that have to be funded by selling Treasury securities. The rumored amount of this stimulus package keeps growing. Treasury Secretary Steven Mnuchin said that it was already over $1 trillion. Others have called for $2 trillion. That’s a heck of a lot of debt to issue in a short time.

The Fed will be buying those securities. But who else will be buying when yields are still this low? That’s the fear among potential buyers – that yields would have to rise further before this becomes attractive for buyers in the future, and current buyers would lose money. And so potential buyers other than the Fed are stepping back.

as the whole financial house of cards is threatening to unravel into what I will now call Financial Crisis 2.

This Financial Crisis 2 was not triggered by mortgage lending or consumers or banks, but by the overripe historic mind-blowing Everything Bubble, including the biggest corporate credit bubble the world has ever seen, being hit by the efforts to slow the spread of the coronavirus. But if the Fed hadn’t spent a decade inflating such a mind-blowing Everything Bubble (that had already begun to wobble), the financial reactions wouldn’t be nearly as chaotic.

No comments:

Post a Comment